My ramblings especially on technology, telecoms, mobile, media, IT and innovation.

Thursday, February 23, 2017

Mind

An attempted assassination of Cash

(Originally published on Medium in December 2016)

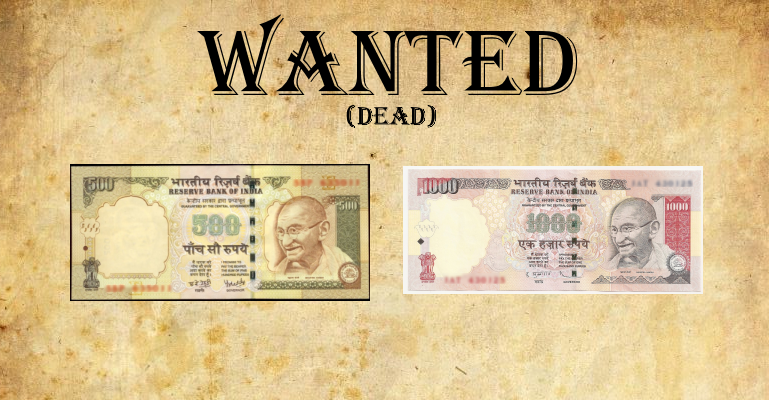

Around 8 PM. November 8th 2016. The Prime Minister, no less, declared that Rs. 500 and Rs. 1000 had been outlawed. Citizens who had given refuge to these bandits had no choice but to turn them in at a bank branch close to them. Chaos ensued. It was a state sponsored witch-hunt of sorts! An open and audacious attempt to assassinate Cash!

The crime? Cash, had this unique ability to remain under the radar. At the same time Cash was everywhere! It was certainly more popular than anything or anyone out there. As if Cash was leading a very popular Resistance. And Resistance has to be crushed. The move seemed to have broad support because of its prospect to weed out ‘black-money’ (sic).

This term itself is a great example of the bias we unwittingly promote. White is equated with good money and black is equated with ill-gotten gains. I wish there were a better term for it. I will refer to them as good-money and bad-money.

While Cash was one of the (many) instruments for those with bad-money, Cash actually represented good-money more! As a result of the witch-hunt, therefore, two sets of people suffered; Those who had hoarded bad-money through Cash and the voiceless majority, who depended completely on Cash. Cash was their good-money, and their only money.

If a certain output is directly proportional and dependent on a variable X. Guess what happens when X tends to zero?

India is known as a Cash based economy. ALL of the Banks, Wallets and Cards combined only covered less than 5 transactions out of every 100 while over 80 were through Cash! It was elementary therefore to deduce that an attack on Cash would push the Indian economy to a grinding halt. Many lives were and are being lost. What was initially billed as a surgical strike was evidently a carpet bombing. Cash was ubiquitous, especially the 500 and 1000 rupee notes. With carpet bombing, there is always collateral damage. In this case however, the collateral damage seems to have overshadowed the intended damage. The government had literally bombed its own economy! The official argument offered is that it this is supposed to be a short-term shock. There might be some solace in that argument, but for many who live from hand to mouth (In India, out of every hundred, over 20 live on less than two dollars a day) this was a rude and a fatal shock. For most of these people, a day with no wages translates to a day without food. Migrant workers who were trying to make a livelihood in urban centres, had been pushed to distress and many were reportedly heading back home.

I am a technologist. I have been at the forefront of an effort to induce digital and mobile payments in India. I have designed and implemented digital money platforms that have processed billions of dollars in digital transactions. However, at no point in time was I under a delusion that Cash could be defeated easily. Over the years, I have developed a healthy respect for Cash as a formidable opponent. In fact, we had even begun to treat it as a worthy ally! This may sound illogical at the outset, but please do bear with me. I have a healthy respect for PayTM, MobiKwik, its clones and the banks and all they have achieved in the de-monetization mayhem, and I wish them well in their endeavour. I hope they are not missing the trees for the woods. It is one thing to buy customers, to acquire them in their desperation and another to actually win them over.

Killing it softly

To those at the helm, the use of lethal and overwhelming force may sound like a logical method to wipe out the ‘Resistance’. Sure, when the opponent is a fringe group, force may overwhelm, but for a movement which is a mainstream way of life, like Cash is; diktats, executive orders and force might in fact achieve quite the opposite! IMHO, best way to subdue Cash is through empathy for the people who use it, a deep understanding of the various contexts and the use of smart design. Embrace Cash; then through a sustained campaign and specific design, ensure that people love Digital Money more than they love Cash. In fact unless Digital Money is designed to be actually loved more than Cash, forced usage only makes people hate it more.

The entire life-cycle of cash needs to be addressed. Start from the government, administration, banks, contractors, distributors, vendors, manufacturers, wholesalers, institutions and contractors. They need to be made digital first and then, enable them to trickle the benefits down to the individuals they employ and interact with.

The banks and the wallet players have a huge responsibility in being accessible and ensuring that the entire ecosystem is taken care of.

Beauty and the beast

Consider Cash for a moment. The beauty and the sheer simplicity of having coloured pieces of paper representing a certain ‘value’, based on the numbers written on them cannot be overstated. Paper Cash as a design solution for people to carry around ‘worth’, that could be combined by simply placing a particular set of such papers together, is wonderful! The ability to get change by exchanging a few leafs of paper is great. The ability to transfer it at proximity by simply handing it over is as intuitive a design as it gets! The most beautiful feature is that when two people are transacting using Cash, there is no third party involved. Just you, me and a sheaf of papers.

Why is this important? In a digital transaction involving banks and other stores of funds, instead of two individuals/ entities transacting, there is always atleast one more entity involved. Here, the individuals have entrusted their money to the ‘bank’ and merely ‘instruct’ their bank to pay someone on your behalf. Of course this is a non-trivial process that involves front-end devices, identity aliases, tokens, encryption (or lack of it), electricity, connectivity, multiple servers, leased lines, core-banking-systems, algorithms and what not! Each of these is beyond the direct control of the two parties primarily involved in the transaction. There are multiple points of failures and multiple factors of failure. Usually, these systems do work as designed, but the kind of up-times required for a nation to be exclusively dependent on it, is lacking.

It would be interesting to see offline digital wallet plays like PaySe playing out in this scenario. It is still a digital device, needs source of power and limited connectivity at the points of ‘loading/ unloading’; it does not require any internet connectivity while doing a transaction. Better, but still not quite as seamless as Cash.

Of course, there is the bitcoin/ crypto-currency narrative. While it does remove the issue of having to trust one entity (bank), it assumes the trust of a peer-network instead and still cannot function in the absence of connectivity. There are other practical issues as well, but that’s besides the point and is a topic for another discussion.

Guess what happens if you build a skyscraper without a solid foundation?

In a country like India where the basic infrastructure of electricity, computing and the internet have not been guaranteed (by the government or someone else), it is naive to assume either the availability or robustness or the proper functioning of these infrastructural elements. In the absence of these guarantees, is it wise to expect citizens to completely ditch Cash and adopt digital money? The government must first attempt making access to electricity, internet and computing a fundamental right and thus available to all its citizens BEFORE imposing instructions that incorrectly assume these elements are present.

Also consider the fact that these elements could be made unavailable either by design (read the many cases of internet being simply turned off by the authorities) or ‘force majeure’, acts of God. God forbid, citizens fall into either one of these events. The truth is, both of these are probable and plausible. Cash needs to be there atleast as plan B.

The progress being made by our minister for electricity, in terms of expanding access is commendable [Do visit this dashboard on Rural Electrification]; but the work is far from over and electricity is just one of the fundamental pieces of infrastructure that is missing. Priorities! Focus!

Time and motion

Sure, cash itself can be designed better! Take the new Australian bank notesfor example. For most routine transactions, Cash simply beats its alternatives in time and motion. [“Time and motion”! Abhishek, had literally drilled this phrase into my mind when my role involved designing the UI and UX for Eko]. While we were trying to shave micro-seconds and clicks off our cash-in/ cash-out transaction UX design, along came an executive order that added DAYS of standing in a line to an otherwise simple and benign transaction of cash withdrawal! To defeat Cash, you need make the UX of conversion between Cash and Digital Money absolutely seamless, non-intimidating and ubiquitous. You need to beat the existing “time and motion” thresholds not multiply them manifold!

In merchant payments, one often ignores the delay, cost and paperwork behind ‘merchant on-boarding’, PoS rentals, device cost, transaction cost, and support. What do you need to accept Cash? Nothing. Just an empty pocket. Even this UX needs to be beaten by Digital. One often hears of the cost incurred by the merchant to store, transport or pay someone else using this cash. Sure, we as solution designers have a problem with it, the government has a problem with it (no/ less tax), but the small merchant does not seem to have that big an issue with it. So, what do we do? We impose a solution. Could we do better? Yes, we could, by designing a better merchant proposition, a better UI for managing their customers, providing better analytics and value added solutions and tangible opportunities to grow their business.

Way of the future

Of course, there are instances where Digital Cash is way better! (Assuming that the basic infrastructure is present and available)

Where distances are involved. It is easier and cheaper to send money electronically across a thousand miles than to send it physically.

Access to credit is another example. Digital Money leaves a digital trail that reduces the cost of assessing the credit worthiness of an individual.

Storage in large quantities. It is indeed easier to store a million rupees as bits and bytes than in stacks of ten rupee notes.

Mass rapid transit. Impossible to imagine running the Delhi Metro without the smooth tap and go payment interface.

Digital Money is the way of the future, I have no doubt. But that future cannot just be hastened through executive orders or shortcuts. This future needs to be designed with empathy and customer-centricity. Of course, one could be reckless and get lucky, but should we count on it? Good design is rarely by accident. It needs time and resources. The path is long and arduous. Before tempting lady luck, the government would do well to ensure that robust basic infrastructure for enabling these are made available to atleast 99 out of every 100 citizens. Even 1 percent in country like India is over 12,000,000! Unlike most enterprises, the government and its actions need to be accountable for and accountable to every single citizen out there.

Re not De

Strictly speaking, as many have already pointed out, this entire exercise could be better referred to as #reMonetization rather than #deMonetization. While two denominations were withdrawn (500 and 1000), they were substituted by one new denomination (2000) and an existing one (500). From the current published trend, it seems like most of the old legit currency that was in circulation is expected to be deposited back at the bank. The currency presses are working on a full swing and a good portion of the demonetized value will be pushed back to the citizens, as new currency, but in an un-co-ordinated and unpredictable manner. The issue is that the gap between the De-monetization and the Re-monetization was significant and painful!

If Digital Money had to win, it should have been planned better. People now are only waiting to get back to (new) Cash! This explains the serpentine queues even 30 days post the D-Day. And once they get Cash, they will hold on to it. Simply because it is now a rare commodity. If Cash was easily accessible, people would not have minded this as much. IF!

When I first opened a bank account on my own (which was after graduation btw!), a major consideration was, to enroll in a bank that had the widest ATM network. Two reasons. One, indeed the acceptance network had barely started back then. Two, trust. The fact that I could, at will, get access to the physical and tangible manifestation of my savings induced trust. For the first time users of digital money, it is important to build up this trust and familiarity. When ATMs and access points are ubiquitous, people tend to withdraw less. Lesser the cash-in, cash-out and payment points, more the urge to hoard Cash. Because Cash is tangible and trust-able. Cash has this place of being the default money instrument.

Epilogue

Thus, right now it looks like only an attempt was made to kill Cash. A cold-hearted attempt and an audacious one no doubt. There is a lot of work to be done before someone even thinks of attempting this again! I hope people at the helm give UX, design and love a chance. If Cash needs to be killed, it must be killed softly.

The point of this post is not just to critique, but to lay out some pointers on the huge amount of work that is still required in the Digital Money space. Indeed, there is no going back and an upheaval of this magnitude is an opportunity. It is indeed awesome to see the government being involved in loudly supporting digital money. A lot more needs to be done and a lot differently. Caution needs to be exercised. There are real real people involved. Lives are at stake. This ain’t SimCity. This is my home. My people. My country.

Jai Hind!

Subscribe to:

Posts (Atom)